(BURKE COUNTY, N.C.) — The next time Tom Andrews visits his doctor, he’ll ask whether cheaper alternatives for life-critical medications are available. If not, the 69-year-old will simply have to live without them — however long that is.

Andrews, who lives in a rural part of western North Carolina, said he takes 11 different medications ranging from insulin, used to regulate his blood sugar levels, to Repatha, which lowers fats in his blood due to a high risk of heart attack, stroke, and other heart problems. His wife, whom he married in 1974 and now uses a wheelchair, has 18 prescriptions.

Both rely on Medicare to cover their health insurance, with UnitedHealthcare as their provider. And while a one-month supply for his Tier 1 medications is fully covered, Tier 2 drugs require a $10 copay, and the deductible for other tiered medications will increase from $340 today to $520 in 2026. Repatha, for instance, is classified Tier 3, which means its cost will increase significantly.

“We’ve got about maybe $6,000 or $8,000 in savings,” he said. “I tell you what. It’s rough.”

Healthcare costs are spiking this upcoming year because of three compounding issues, healthcare experts said. Those include: Congress failing to extend Affordable Care Act tax credits amid the longest federal government shutdown in American history; the North Carolina General Assembly remaining gridlocked over Medicaid funding more than 150 days past its budget deadline; and the slashing of Medicaid and Medicare funding.

If rural North Carolina residents like Andrews can’t access affordable health benefits, they may have to completely forgo what is considered life-saving care.

Andrews and his wife spent roughly three decades working for Henredon Furniture in Morganton, a city of nearly 18,000 people in Burke County, 45 minutes east of Asheville. Henredon is one of many furniture companies that have closed or left the foothills region since the 1990s, and was affected in the early 2000s when local furniture production was replaced by imports that took advantage of cheaper labor and fewer regulations in foreign markets.

The local economy has struggled to rebound ever since, further set back by the recent devastation from Hurricane Helene in 2024.

Around the time employment in the furniture industry was being hollowed out, both Andrews and his wife went on disability: he in 2006, after two major back surgeries, and she following a heart attack. Difficult decisions lie ahead.

‘The biggest cut to our safety net in history.’

According to Liz Fowler and Gerard Anderson, health policy scholars at Johns Hopkins University, these dramatic cost increases are largely due to a combination of cuts to Medicare and Medicaid as part of the GOP-led “One Big Beautiful Bill,” signed into law by President Donald Trump earlier this year, and the sunsetting of Affordable Care Act (ACA) tax credits.

Fowler has called it “the biggest cut to our social safety net in history.”

A landmark piece of legislation signed into law by then-U.S. President Barack Obama in 2010, the ACA marketplace is also known as Obamacare. The bill made healthcare more affordable to a large swath of the population by providing financial assistance for coverage. More than 49 million Americans had coverage through the ACA marketplace at some point during the first decade it was in place, from January 2014 to May 2024, according to the U.S. Department of the Treasury.

Since its passage, Republicans have sought to weaken or repeal the ACA marketplace, arguing it drives up healthcare costs and favoring market-based alternatives rather than one they view as a government overreach. Opposition to it, however, has diminished in the years since its initial rollout. And while the GOP is united in its opposition to Obamacare, nearly six in ten enrollees live in Republican congressional districts and are “more likely to reside in rural areas,” Ashley Kirzinger with KFF’s Public Opinion program said.

North Carolina residents buying insurance on the ACA marketplace can expect an average rate increase of nearly 28.6% in 2026, according to an October 29 press release from the state’s Department of Insurance. Many healthy individuals who have enrolled in the past are expected to opt out of health insurance altogether if they can’t afford it.

“If hospitals start to see an increase in the number of uninsured people who aren’t able to pay their bills, they’re going to increase rates for other payers,” Fowler explained in a July interview for the Bloomberg School of Public Health. “The U.S. health system is like a balloon: When you squeeze one part of the balloon, the rest of the balloon stretches out.”

Tim Moore, U.S. Representative for Burke County and a Republican, voted for the “Big, Beautiful Bill,” which permits ACA tax credits to sunset at the end of 2025. [Credit: Tim Moore]

“Americans are being reminded that the Affordable Care Act was never truly affordable as the COVID-era tax credits expire,” Moore said during the 43-day shutdown. “Senate Democrats are holding hardworking Americans hostage for a short-term fix that fails to solve the long-term cost crisis created by Obamacare.”

According to an analysis from nonprofits Peterson Center on Healthcare and KFF, post-pandemic inflation, increased labor costs, hospital consolidations, increased prescription drug spending, and tariffs are also contributing to overall healthcare cost increases in 2026.

‘Those are life-saving medicines they need.’

Calling it a “big money racket,” Andrews laments what the dysfunctional nature of the U.S. healthcare system foretells for his nephew, Chase Carswell. Like the younger members in many rural families in Southern Appalachia, Carswell assists his aunt and uncle with daily tasks and travel, helping where he can — likely, in part, out of economic necessity.

Similar dynamics are playing out all over the Burke, where 14.1% live below the poverty line.

Chase Carswell relies on Medicaid for health insurance coverage, while making $13 an hour, which isn’t likely enough to cover all his medical needs. [Credit: Jeffrey Howard]

The 20-year-old said he currently earns $13 an hour as a cashier at Murphy’s, a position Andrews noted his nephew secured after participating in four phone interviews and submitting up to between 75 and 100 applications for various jobs.

“Even if you made $20 an hour, you still couldn’t afford health insurance,” his concerned uncle said. “I got him some help with Medicaid, but that’s fixing to sink. I don’t know what we’re gonna do now.”

Multiple failures at the state level

It doesn’t help that the North Carolina General Assembly has also failed to pass the 2025-2027 state budget, participating in its own government standoff. The legislative body has blown past its July 1 deadline.

Republican legislators are in a stalemate with North Carolina Governor Josh Stein, a Democrat, over several key points. This includes competing proposals regarding the state’s Medicaid rebase — the cost to cover changes to the number of people enrolled in the program and provide care — and funding for a children’s hospital in Apex.

Governor Josh Stein, a Democrat, has been at odds with the North Carolina General Assembly, controlled by the GOP, wrestling over a state budget that is more than 5 months past its July 1 deadline. [Credit: Josh Stein]

In the meantime, the state’s Department of Health and Human Services (DHHS) is relying on a “mini budget” signed into law by Stein on August 6. The $600 million included to address Medicaid costs falls $319 million short of what DHHS officials claim is needed to fully fund Medicaid.

To adjust for this shortfall, healthcare providers are now being reimbursed by up to 10% less than they have been, DHHS officials said, effective October 1.

These rate cuts may force providers — particularly those in rural areas like Morganton, Valdese, and Hildebran — to either turn away Medicaid patients or stop offering a medical service entirely. In turn, more families will go without healthcare coverage, which means when they do receive essential medical care and can’t pay, costs will inevitably be passed along to the rest of the payers within the broader healthcare ecosystem.

Healthcare clinicians are already having to adjust to another statewide healthcare change for a “more secure financial footing,” said Treasurer Brad Briner in an August press release. State employees on the state health plan will pay higher premiums and healthcare clinicians will be reimbursed at a lower rate for providing the same services.

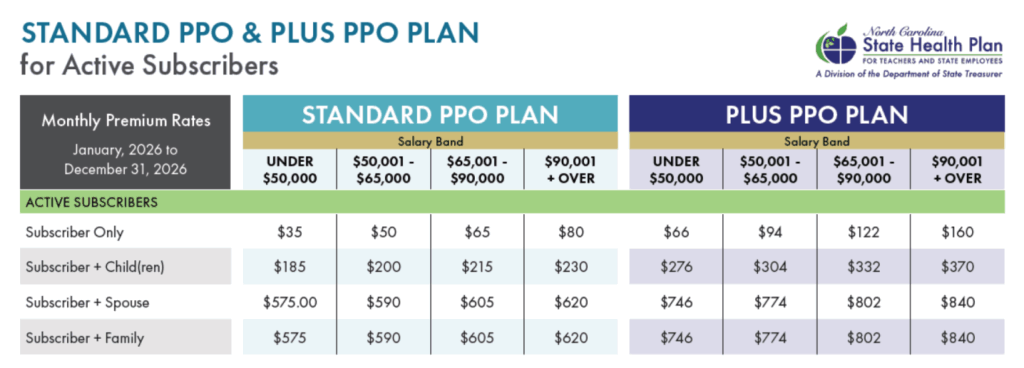

The state health plan is financially overburdened, having spent more during the past eight years than it has taken in. Monthly premiums for the more than 750,000 subscribers on the plan have increased on average from $35 to $50 more per month.

Monthly premiums for the more than 750,000 state subscribers on the plan have increased on average from $35 to $50 more per month, which is between a 16% and 32.1% increase from 2025. [Credit: NC State Health Plan]

“Each office or clinic will now start being paid at Aetna commercial rates, and Aetna commercial rates differ practice by practice,” Edhegard said. “Bigger practices may have more negotiating power, so they may get paid more by Aetna. Whereas small practices like mine have no leverage.”

She believes the diminished reimbursements will cause providers to have to turn patients away. This will force rural North Carolinians to “drive a longer distance for care,” pushing healthcare affordability further out of reach, she said.

“They’re going to see higher co-pays or plans that have a deductible instead of co-pays.” Edhegard said. “So there may be more Burke County residents, especially dependent spouses and children, who will have to go without insurance.”

This article also appears in The Paper by permission.