(HACKETTSTOWN, New Jersey) – Sports betting is not anything new. In fact, in the U.S., it even dates back to 19th century horse racing. What is also not new is the way in which sports bets are placed: a bettor places a bet with a bookmaker, or “bookie”, who makes the odds; bookies pays the bettor if the bet is won or “hit,” keep the money if the bet lost.

But today, smartphones have been able to connect bookies and bettors all over the country, and a growing number of startups are taking advantage of that in an effort to shake-up the long-standing industry.

Currently, 15 states plus Washington, D.C allow for mobile sports betting. With analysts expecting legal sporting event wagers to reach $81 billion by 2024, the online sports betting industry is poised to continue growing as more states express interest in legalization.

Startups are not alone though. They join a crowded market of big-name casinos and already-established platforms that’ve cashed in on the growing number of states legalizing online sports gambling. But there’s a corner of the industry that entrepreneurs are reinventing to stand out in the crowded room: startups such as The Action Network, PickUp and Matchbets are betting that sports fans want a more social experience when they bet. They just might be right – all 3 platforms have reported a surge in user growth recently.

The amount of funding established platforms such as DraftKings, Fanduel and Barstool Sports receive creates a high barrier for entry for startups. This has forced The Action Network, PickUp and Matchbets to rethink what they have to offer that these larger platforms don’t.

“I’m not at all surprised to see companies trying to innovate and find a different way in,” Adam Candee, managing editor of Legal Sports Report, told The Click.

Player vs. Player

Matchbets, founded in 2019, is one of those companies looking to shake things up as it prepares for its US-debut later this year. Currently operating in Canada and the U.K., Matchbets takes the bookie out of the traditional betting equation and lets users bet against each other, hence “matching” another user’s bet.

For example, if you think the Tampa Buccaneers are going to win Sunday’s football game, you can propose the bet on Matchbets’ platform of more than 1,000 other users. If another user thinks the Buccaneers won’t win, they can take you up on your bet. Chat and direct messaging features are also available on the platform.

Mark Krause, CEO and founder of Matchbets, touts himself as a long-time fan of the idea of sports betting, “But there’s just always something missing with sports betting,” he added in an interview with The Click. In 2018, the Supreme Court lifted the federal ban on sports betting clearing the way for states to legalize the business and with that, Krause saw an opportunity.

“Bettors are always playing against the house and not playing against each other,” Krause said. But that traditional method lacked a social aspect to it, which Matchbets seeks to fulfill. “I think that’s what’s really needed in the marketplace.”

By pitting players against each other and not the house, Krause does not have to worry if the house (Matchbets) wins the bet; just that a bet is made. Because of that, Matchbets takes a two percent fee for each bet on its platform, which it claims is much lower than traditional house fees. The company declined to share information related to its revenue but it is currently undergoing additional funding, according to Krause, who confirmed the company has raised $650,000 to date.

“[Sports betting] is exciting, but it can be so much more,” Krause said. “It gives you a little bit more bang for your buck when you’re playing against other people as opposed to the house.”

Vegas Tools for the Average Sports Bettor

The Action Network, a sports analytics and media company, is aiming for its original news and betting tools to become a go-to companion to traditional sportsbooks. Subscribers get access to original news content, expert betting projections and various betting tools such as odds calculators. And in an effort to add a social component to gambling, users get insight into the more than 100 million bets other users are making, which shows you what percentage of bets are being placed on any given option.

The company, founded in 2018, raised more than $17 million to date and has undergone significant growth in just a few short years. This past February’s Super Bowl saw new registered users on the platform increase 513 percent year-over-year, according to the company’s press release. On that day alone, fans spent a collective 2.4 years checking The Action Network’s app.

Subscription pricing starts at roughly $8 per month when billed on an annual basis. Free users can also get limited access to some of the site’s features. Along with its subscription model, the company earns an affiliate fee by linking to various sportsbooks.

The Action Network did not respond to The Click’s request for comment.

No Money. No Problem

Other startups are taking money right out of the equation. Founded in 2019, PickUp doesn’t require any money to place a bet. Contrary to traditional gambling, bets on PickUp are free.

The platform allows winners to earn points towards prizes they can redeem. Currently, the company offers prizes at Bowlero, one the largest ten-pin bowling operators in the world, but future prizes could include companies like Fanatics, a sports apparel company, and Hyperice, which creates handheld massage devices for athletes, according to Dan Healy, co-founder and CEO of PickUp.

PickUp was built to support the broader 150 million American sports fans who might not otherwise bet on sports, Healy, a long-time sports fan himself, explained to The Click. With no money involved, the company is only subject to sweepstakes laws and skirts the sports betting restrictions that the industry is still facing.

PickUp also doesn’t have to rely on bookmakers to create bets and figure out the odds. The company uses artificial intelligence to gather audience sentiment around any given sports game by combing through public discussions on platforms like Twitter and news outlets. Publishers can pay to license that data and embed PickUp bets in articles, which Healy says drives engagement.

“What we do is we tap into the conversation that is happening in sports communities,” Healy said.

The company reported that it has partnerships with a network of more than 100 independent publishers and is “onboarding 1-3 new publishers a day.” PickUp also receives an affiliate fee anytime it directs PickUp users to place bets with real money on other sportsbooks.

The company declined to share financials but Healy noted that the company is generating revenue.

Publishers aren’t the only ones growing on the platform. Daily user acquisition grew 400 percent year-to-date, which is generating more than hundreds of thousands of picks per month, according to Healy.

A Modern Day Gold Rush

Innovating in the sports gambling industry without the capital that larger sports betting companies have is a means of survival for these startups, but much to their benefit, the market is poised to expand in the near future.

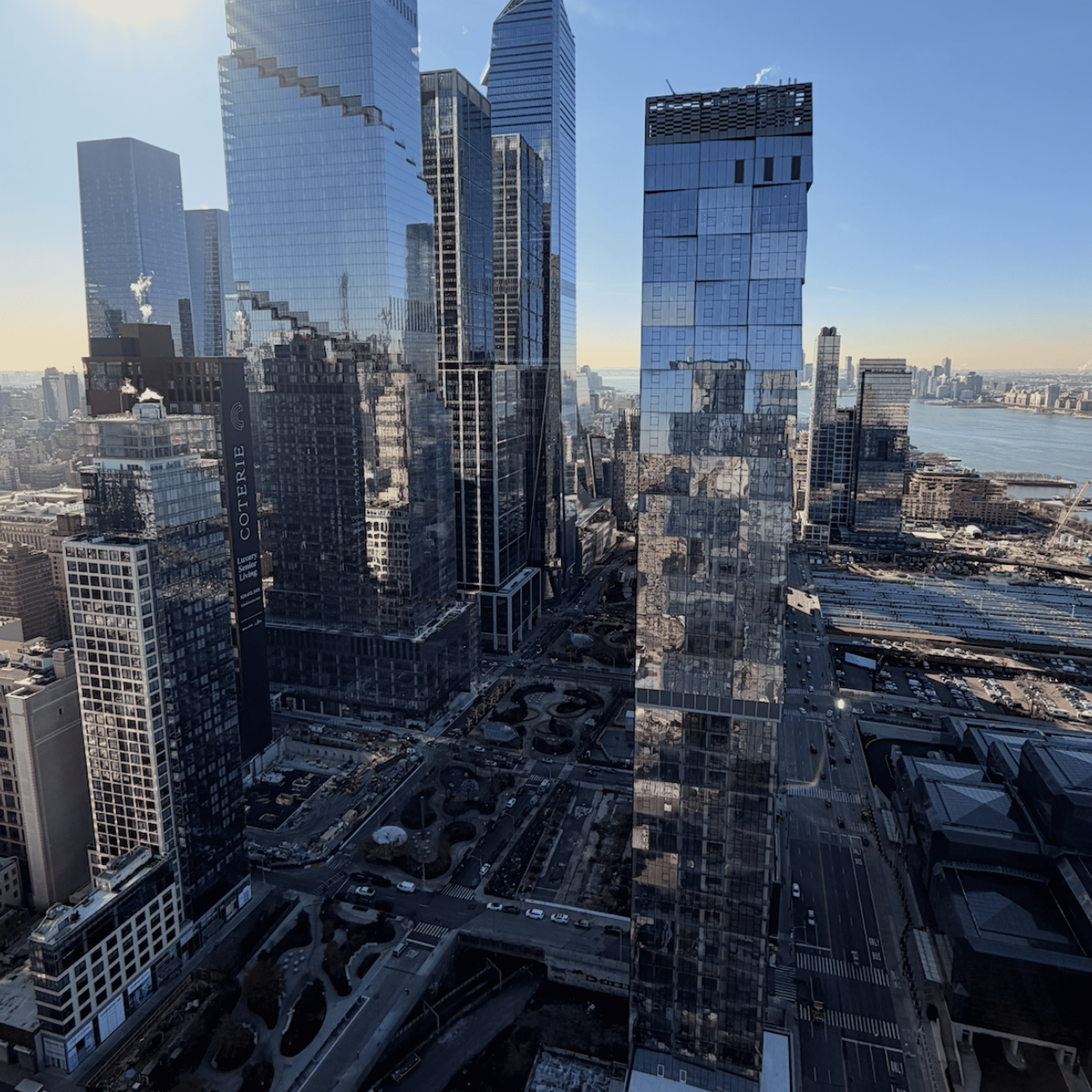

New York’s Governor Andrew Cuomo recently announced that mobile sports betting would “soon” come to the state, which, if it happens, would open up one of the largest sports betting markets in the country, as reported by Yahoo Sports. That is likely to chip away at New Jersey’s annual revenue from sports betting – the highest in the country – which is legal on mobile devices in the state. In December 2020 alone, New Jersey generated a whopping $66.4 million from sports gambling according to a state report.

To capitalize on that growing market, startups will continue to lean into alternative betting experiences, but with any alternative to the norm comes the challenge of adoption.

“When it comes to innovation within products, there’s the challenge first of gaining acceptance and comfort with the traditional sports betting products,” Candee said. “And then there’s a challenge beyond that with getting people used to the idea of derivative markets and derivative products.”

But if startups can hurdle high-entry costs and find user adoption, according to Candee, they’ll stand to benefit from the holy grail for sportsbooks: retention.

“When it comes to engaging customers and finding ways to keep them active on their platforms. I think that’s where the social part of the experience comes in more,” Candee said.